An Overview of Umbrella Insurance Policies

To protect your loved ones and home effectively, it’s crucial to understand umbrella insurance policies. Consider it an extra layer of security that extends beyond your standard home insurance. So, what exactly is an umbrella policy, and why should you get one?

An umbrella insurance policy provides additional liability coverage beyond what your primary insurance policies offer, such as homeowners or auto insurance. It acts as a safety net when your underlying policies’ limits are reached. This added protection can be invaluable when a claim or lawsuit exceeds your base policy’s coverage.

One significant advantage of an umbrella policy is its coverage of various liability risks. Whether it’s a dog bite, an accident on your property, or a libel lawsuit, it can help protect you from severe financial losses. It safeguards your assets, including savings, investments, and future earnings, ensuring comprehensive protection for your loved ones and home.

Assessing Your Coverage Needs: Evaluating Risks and Family Protection

Now that you understand umbrella insurance, it’s time to evaluate your coverage needs. Every homeowner’s situation is unique, so considering several factors is crucial to determine the right level of protection for your family and home.

Begin by assessing your risks. Consider your regular activities, potential liability exposures, and factors like owning a swimming pool, pets, or hosting gatherings at home. These elements increase the risk of accidents or incidents resulting in liability claims.

Take your net worth and assets into account. The more you have to protect, the more coverage you might need. Evaluate your home’s value, savings, investments, and other valuable assets to gauge the potential financial impact of a liability claim and choose appropriate coverage limits.

Consider your future earnings as well. Lawsuits can lead to substantial judgments, and inadequate insurance coverage risks your future earnings. An umbrella policy ensures peace of mind, knowing your financial future is secure.

Umbrella policies offer extensive coverage but at an additional cost. Assess your budget and weigh the benefits against the premium cost. Being underinsured can have severe financial consequences, outweighing the investment in comprehensive umbrella coverage.

Lastly, expertise and project scope can aid in assessing your coverage needs. If you’re unsure about insurance policies’ intricacies or have unique circumstances, seeking advice from an insurance agent or broker is invaluable. They’ll help you understand umbrella insurance nuances, accurately assess risks, and select the right policy for your specific needs.

You can make informed decisions about your umbrella insurance policy by carefully evaluating your coverage needs based on personal risks, net worth, future earnings and budget, and seeking professional advice. Remember, the goal is to balance coverage and affordability while protecting your loved ones and home.

Top Brands of Home Insurance Sellers: Pros and Cons Analysis

When choosing the best umbrella insurance policy for your home, it’s important to consider the nation’s top brands of home insurance sellers. Let’s take a closer look at these leading companies and explore the pros and cons associated with each.

***To understand the cost of average umbrella insurance policies from these companies, consult their official websites or contact a licensed insurance agent. Insurance premiums vary based on location, coverage limits, personal circumstances, and discounts. By obtaining quotes and comparing prices, you can make an informed decision that aligns with your budget and coverage needs.

Liberty Mutual

Liberty Mutual is a well-established insurance provider known for its comprehensive coverage options. Their umbrella insurance policies offer substantial protection, enhancing liability coverage. Their customer service is exceptional, providing reliable assistance when needed. Their premiums might be higher than other providers, so evaluate your requirements and budget.

GEICO

GEICO is a popular home insurance choice and offers umbrella insurance policies. One significant advantage of GEICO is its competitive pricing, often providing umbrella coverage at affordable rates. This makes it attractive for homeowners looking to save money. However, carefully review their coverage limits to ensure they meet your needs. Additionally, GEICO’s umbrella policies may have limitations in coverage scope, so consider this factor as well.

Allstate

Allstate is another prominent name in the insurance industry, offering umbrella insurance policies to homeowners. They provide flexible coverage options, allowing you to tailor your policy to your requirements. Allstate’s exceptional customer service and various discounts help you save on premiums. Review their pricing structure and compare it to other providers to ensure the best value for your money.

Farmers

Farmers Insurance offers an extensive range of insurance products, including umbrella policies for homeowners. One advantage of choosing Farmers is their personalized approach to coverage. They work closely with customers to understand unique needs and provide customized solutions. Farmers also offer discounts that reduce the cost of your umbrella policy. Review their coverage limits to ensure they align with your requirements.

Travelers

Travelers Insurance is a respected company offering umbrella policies to homeowners. They are known for broad coverage options and flexibility in tailoring policies. Travelers provides excellent customer service and offer discounts.

Chubb

Chubb is a renowned insurance provider specializing in high-value insurance solutions, including umbrella policies for homeowners. They offer comprehensive coverage and excellent customer service. Chubb’s umbrella policies provide broader protection and higher coverage limits than standard offerings. Note that their premiums may be higher due to the enhanced level of coverage and service.

USAA

USAA is a trusted insurance provider serving military members and their families. They offer umbrella insurance policies for additional protection. USAA’s policies often come with competitive pricing and excellent customer service tailored to the unique needs of military families. Eligibility for USAA’s products is limited to military personnel and their immediate family members.

Understanding Adequate Protection: Exploring Policy Coverage Limits

When it comes to umbrella insurance, understanding coverage limits ensures adequate protection for your family and home. Coverage limits refer to the maximum amount your insurance policy pays for a covered liability claim. Consider these key points when evaluating your coverage limits:

1. Personal Net Worth: Calculate your net worth by assessing assets, including your home, investments, savings, and valuable possessions. As a general rule, it’s recommended to have coverage exceeding your net worth to protect against potential financial losses.

2. Property Value: Consider your home’s value when determining coverage limits. Your umbrella policy should adequately cover potential costs of liability claims related to your property. Factors like size, location, and features influence appropriate coverage limits.

3. Potential Liability Risks: Assess potential liability risks as a homeowner. Do you have a swimming pool, trampoline, or a dog? These factors increase exposure to liability claims. Evaluate these risks’ likelihood and potential financial impact when setting coverage limits—balance asset protection with affordability.

4. Balancing Coverage and Affordability: While sufficient coverage is crucial, consider budget constraints. Higher coverage limits come with higher premiums. Evaluate your finances and determine what you can comfortably afford. Remember, some umbrella coverage is better than none. Adjust coverage limits as your financial situation evolves.

5. Consultation with an Insurance Professional: Seek guidance from an insurance agent or broker if unsure about appropriate coverage limits. They assess your circumstances and provide personalized advice. Professionals help understand potential risks, evaluate net worth, and select coverage limits offering suitable protection for your family and assets.

Saving Money on Umbrella Insurance: Tips and Strategies

While umbrella insurance provides valuable protection, you can save money on premiums without compromising coverage. Here are practical tips to help lower the cost of your umbrella policy:

Bundle Policies

Consider bundling your umbrella policy with other insurance policies, like home or auto insurance, for potential discounts and comprehensive coverage.

Increase Deductibles

Opt for a higher deductible to reduce premiums. Ensure you have sufficient funds to cover the deductible in case of a claim.

Regularly Review Coverage Needs

Adjust coverage limits as your financial situation changes to avoid overpaying for unnecessary coverage.

Maintain a Good Credit Score

A good credit score can lead to lower insurance premiums. Keep your credit score in good standing for better rates.

Shop Around and Compare Quotes

Obtain quotes from multiple insurance providers to find the most competitive rate for the coverage you need.

Remember to prioritize adequate coverage while saving money. Balancing cost-effectiveness and comprehensive coverage ensures protection for your loved ones and assets.

Examining Policy Exclusions and Limitations: Understanding the Fine Print

When considering an umbrella policy, examining the fine print and understanding policy exclusions and limitations is crucial. Consider these key points:

Coverage Exclusion

Familiarize yourself with exclusions like intentional acts, business-related liabilities, or professional liabilities to understand situations where umbrella coverage may not apply.

Underlying Insurance Requirements

Ensure your primary policies, such as homeowners or auto insurance, meet the minimum limits required by the umbrella policy to avoid affecting your ability to make a claim.

Self-Insured Retention (SIR)

Understand the SIR amount, the out-of-pocket payment required before umbrella coverage applies, and consider your financial capabilities in case of a claim.

Jurisdictional Limitations

Review limitations on coverage for incidents outside specific jurisdictions or countries if you travel frequently or own properties in different locations.

Policy Language and Definitions

Pay close attention to the language and definitions used in the policy to avoid misunderstandings. Understand the meanings and interpretations of terms and phrases that can impact coverage.

By considering these factors and understanding the fine print, you can make informed decisions about your umbrella policy and avoid surprises when filing a claim.

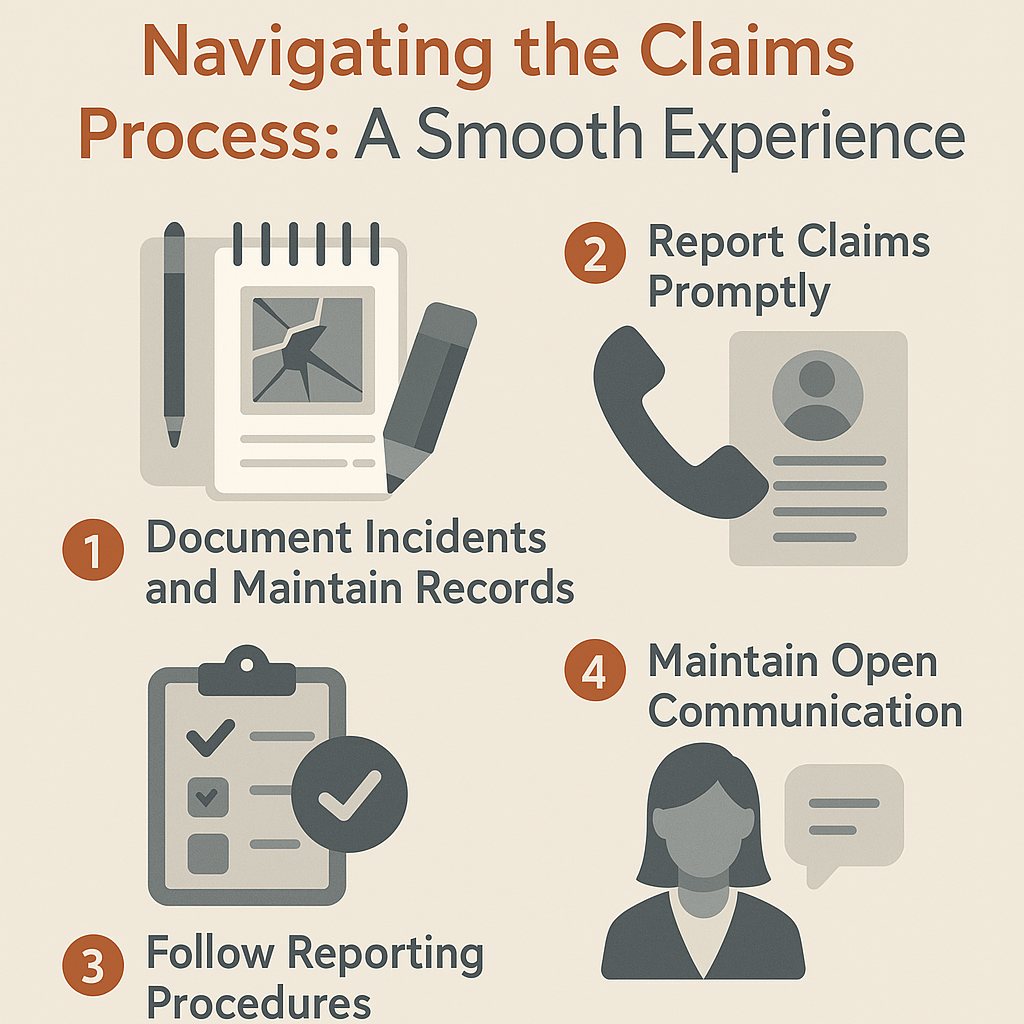

Navigating the Claims Process: A Smooth Experience

Sometimes we need to file claims for unfortunate events; at those times, understanding how to navigate the process is crucial at those times. Follow these tips for a smooth and efficient experience:

1. Document Incidents and Maintain Records: Gather evidence like photographs, witness statements, and paperwork to support your claim. Keep records organized and easily accessible.

2. Report Claims Promptly: Notify your insurance provider immediately after an incident. Delaying the report may complicate the process and affect coverage. Provide all necessary information and cooperate fully.

3. Follow Reporting Procedures: Familiarize yourself with the reporting procedures of your insurance company and ensure compliance. Failure to do so can impact claim processing.

4. Maintain Open Communication: Respond promptly to requests for information or documentation. Clear and timely communication expedites the process and ensures efficient claim handling.

Umbrella insurance provides financial protection when needed. By understanding the claims process and following these tips, you can maximize the benefits of your coverage.

Seeking Professional Advice: The Role of Insurance Agents and Brokers

Seeking professional advice from insurance agents or brokers is highly beneficial when dealing with umbrella insurance policies. Here’s why:

1. Expertise and Knowledge: Agents and brokers possess in-depth insurance industry knowledge. They explain policy terms, guide you through complexities, and ensure well-informed decisions based on your needs.

2. Personalized Guidance: Professionals understand your requirements and assess your risks. They recommend suitable coverage tailored to your situation for optimal protection.

3. Access to Multiple Providers: Agents and brokers work with various insurance companies, providing options for coverage, rates, and benefits. This allows you to compare and find the best policy for your needs and budget.

4. Assistance with Claims: Agents and brokers act as your advocates. They provide guidance, help gather documentation, and communicate with the insurance company on your behalf.

5. Ongoing Policy Management: Professionals assist in managing your policy over time. They review coverage, consider changes, and recommend adjustments or additional coverage.

Considering these advantages, homeowners can make informed decisions, ensure protection for their loved ones and homes, and receive ongoing support.