Closing On A House: Timeline and Next Steps

We’re here to support homeowners in every aspect of homeownership, and that includes the process of home buying. Closing on a home, being the final step, is important to understand, so let’s go over timeline and what to expect.

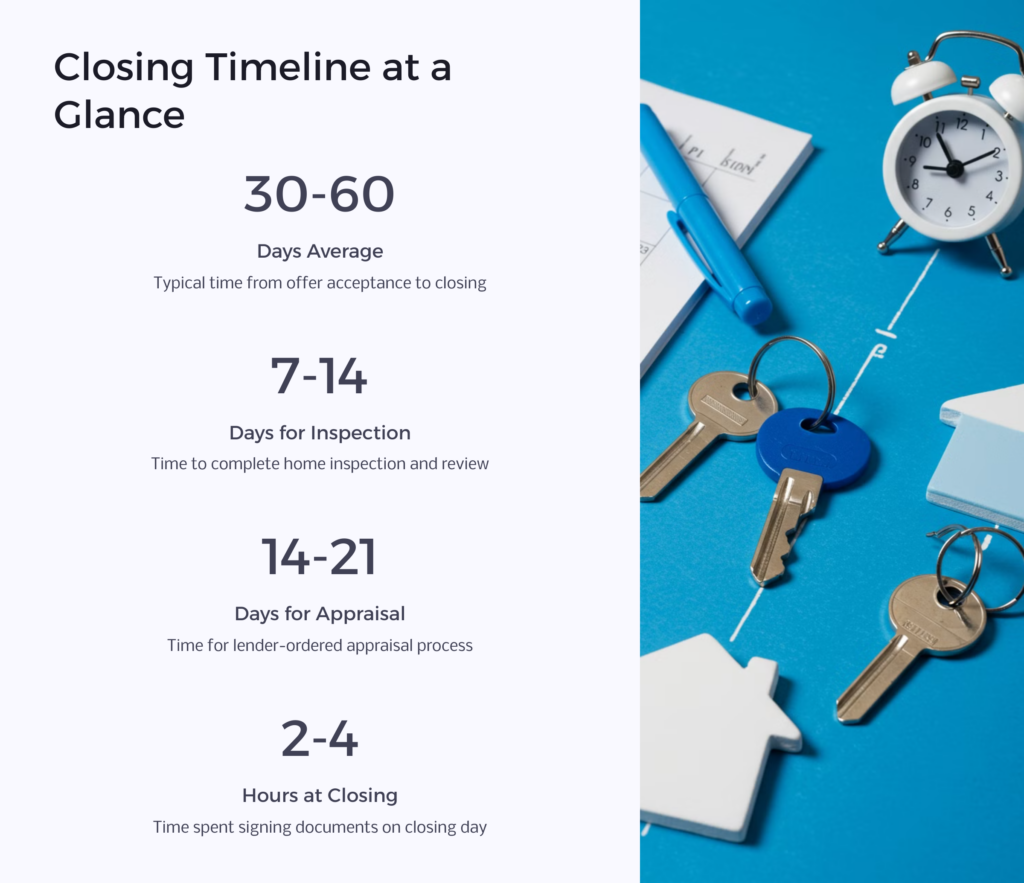

The closing process—the period from having your offer accepted to receiving the keys to your new home—typically takes 30 to 60 days, with most closings averaging around 45-50 days. However, this timeline can vary significantly depending on numerous factors, including financing method, loan type, market conditions, and the preparedness of all parties involved.

Closing Timeline by Purchase Type

- Cash Purchases: 1-2 weeks (sometimes as quick as 10-14 days)

- Conventional Loans: 45-48 days on average

- FHA Loans: 51-54 days on average

- VA Loans: 52-57 days on average

The Complete Home Buying Journey vs. The Closing Process

Before diving into the closing timeline specifically, it’s important to understand where closing fits within the broader home buying journey.

The Complete Home Buying Journey (2-12 months)

- Financial Preparation: Saving for down payment and closing costs (months to 1+ year)

- Mortgage Pre-Approval: 1-2 weeks (can be as quick as 1-2 days with some lenders)

- House Hunting: Few days to several months

- Making an Offer and Negotiation: 1-7 days

- Closing Process: 30-60 days (focus of this article)

Detailed Closing on a House Timeline: Week by Week

Week 1: Getting Started (Days 1-7)

Day 1-3: Initial Steps After Offer Acceptance

- Sign the purchase agreement

- Submit earnest money deposit (typically 1-3% of purchase price)

- Open escrow account

- Begin formal mortgage application process

- Schedule home inspection

Day 3-7: Home Inspection Phase

- Complete home inspection (takes 2-4 hours)

- Receive inspection report (usually within 24-48 hours after inspection)

- Negotiate repairs or credits if issues are discovered

- Begin gathering financial documents requested by your lender

Weeks 2-3: The Due Diligence Period (Days 8-21)

Key Activities:

- Lender orders home appraisal

- Title search begins (10-14 days)

- Mortgage underwriting process starts

- Shop for homeowners insurance

- Address any inspection-related negotiations

- Complete loan application requirements

Pro Tip: This is a critical period where delays commonly occur. Stay proactive by promptly responding to all lender requests for documentation and keeping open communication with your real estate agent.

Weeks 4-6: Finalizing the Mortgage (Days 22-42)

Key Activities:

- Appraisal report received and reviewed

- Title search completed

- Title insurance arranged

- Mortgage underwriting continues

- Conditional loan approval and addressing any conditions

- Final loan approval (“clear to close”) typically received

- Closing Disclosure received (at least 3 business days before closing)

Important Note: Mortgage underwriting is often the most time-consuming part of the process. During this phase, avoid making major purchases, taking on new debt, or changing employment, as these actions could jeopardize your loan approval.

Final Days: Preparing for Closing (Days 43-45)

Key Activities:

- Review Closing Disclosure (mandatory 3-day review period)

- Final walkthrough (usually 24-48 hours before closing)

- Prepare certified funds for down payment and closing costs

- Gather required identification and documents for closing day

Closing Day: The Final Step

What Happens on Closing Day:

- Meeting duration: Typically 1-3 hours

- Sign all closing documents (expect a substantial stack)

- Pay closing costs and down payment

- Deed and mortgage are recorded

- Funds are disbursed to appropriate parties

- Receive keys to your new home

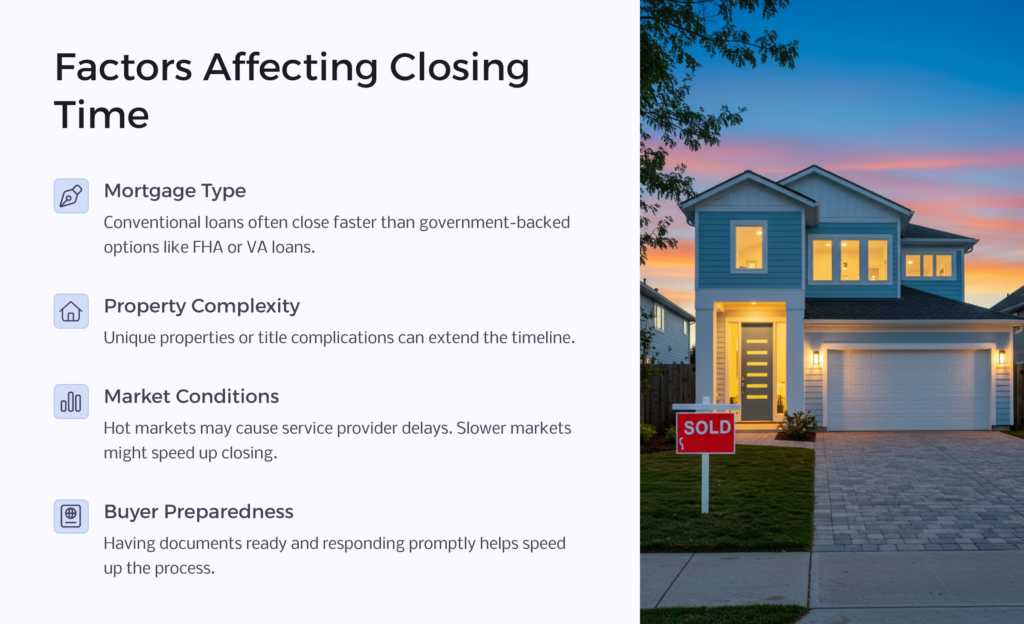

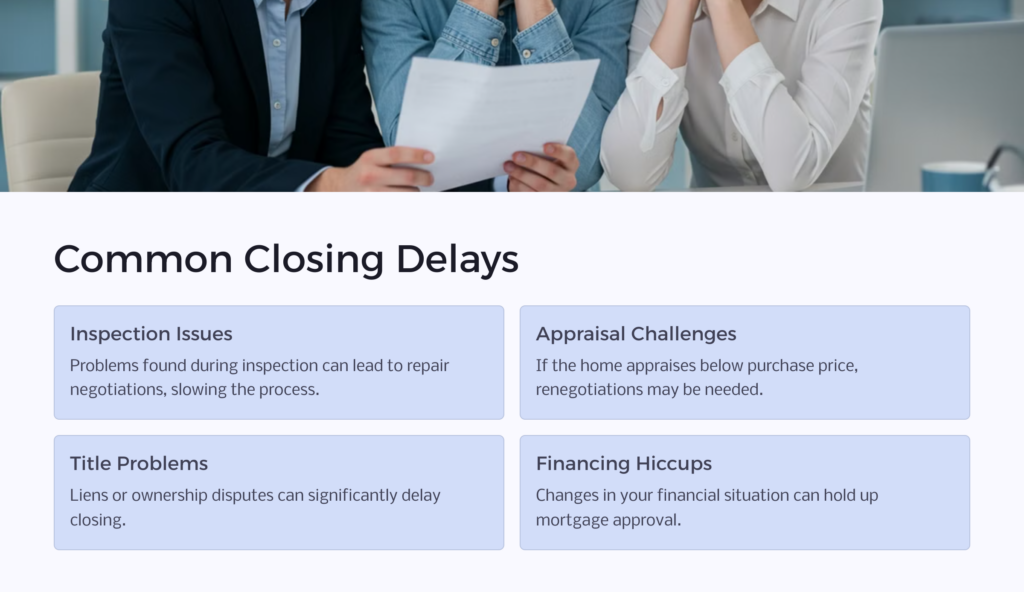

7 Factors That Can Delay Closing on a House

According to the National Association of Realtors, approximately 20-24% of closings experience delays. Understanding the common obstacles can help you avoid or quickly resolve potential issues:

1. Financing Complications

Financing issues are the most frequent cause of closing delays. These can include:

- Changes in employment or income

- New debt affecting debt-to-income ratio

- Credit score fluctuations

- Insufficient documentation

- Lender backlog

2. Appraisal Problems

If the home appraises for less than the agreed purchase price, this can cause significant delays while the parties renegotiate terms or the buyer secures additional funds to cover the difference.

3. Home Inspection Issues

Discovering major problems during the inspection can lead to extended negotiations or requests for repairs that take time to complete.

4. Title Issues

Unresolved liens, judgments, boundary disputes, or unclear ownership history can take weeks or even months to resolve.

5. Contingency Fulfillment

If your purchase is contingent on selling your current home or other conditions, closing can only proceed when those contingencies are satisfied.

6. Documentation and Communication Problems

Missing paperwork, errors in documents, or poor communication between parties can create unnecessary delays.

7. Final Walkthrough Surprises

Finding new damage or incomplete repairs during the final walkthrough can lead to last-minute negotiations and postponements.

10 Expert Tips to Speed Up the Closing Process

While some factors affecting the closing timeline are beyond your control, these strategies can help expedite the process:

1. Get Pre-Approved Before House Hunting

Obtain a solid pre-approval letter before making offers to demonstrate serious intent and streamline the financing process after offer acceptance.

2. Organize Your Financial Documents

Gather all necessary financial documents (W-2s, tax returns, bank statements, etc.) early and create digital copies for quick submission.

3. Maintain Financial Stability

Avoid making large purchases, opening new credit accounts, or changing jobs between pre-approval and closing.

4. Choose Experienced Professionals

Work with reputable, experienced real estate agents, lenders, and attorneys who understand how to navigate potential obstacles efficiently.

5. Respond Promptly to All Requests

Quick responses to information requests from your lender, title company, or other parties can prevent unnecessary delays.

6. Schedule Inspections Immediately

Book the home inspection, pest inspection, and other necessary evaluations as soon as possible after your offer is accepted.

7. Review Documents Thoroughly and Promptly

Carefully examine all documents but do so quickly to maintain momentum in the process.

8. Consider an Appraisal Gap Guarantee

If you’re in a competitive market with rising prices, consider including an appraisal gap guarantee in your offer to prevent delays if the home appraises below the purchase price.

9. Address Potential Title Issues Proactively

Sellers can order a preliminary title report before listing to identify and resolve potential issues early.

10. Consider a Cash Offer

If speed is your top priority and you have the means, making an all-cash offer eliminates the mortgage process and can reduce closing time to as little as 1-2 weeks.

Closing on a House Timeline by Loan Type: What to Expect

Different types of mortgage loans have varying requirements that can affect your closing timeline:

Conventional Loans (45-48 days)

- Why This Timeline: Conventional loans typically have the most streamlined process among financed purchases.

- Key Requirements: Credit score typically 620+, down payment often 3-20%, debt-to-income ratio usually below 45%.

FHA Loans (51-54 days)

- Why This Timeline: FHA loans require additional property inspections and more stringent appraisal standards.

- Key Requirements: Credit score as low as 500 (with 10% down) or 580 (with 3.5% down), property must meet specific safety and structural standards.

VA Loans (52-57 days)

- Why This Timeline: VA loans involve VA-specific requirements and additional paperwork to verify military service eligibility.

- Key Requirements: Certificate of Eligibility, VA-approved appraisal, property must meet VA’s Minimum Property Requirements.

Cash Purchases (7-14 days)

- Why This Timeline: Without financing contingencies, the process is significantly accelerated.

- Key Requirements: Proof of funds, title search, and home inspection (if desired) are still typically conducted.

What to Expect on Closing Day: Your Step-by-Step Guide

After weeks of preparation, closing day arrives—the final step before becoming a homeowner. Here’s what typically happens:

Before the Meeting

- Conduct final walkthrough (usually 24-48 hours before closing)

- Prepare certified funds for closing costs and down payment

- Gather required identification and any additional documents

During the Closing Meeting (1-3 hours)

- Identity verification of all signing parties

- Review and sign loan documents, including:

- Promissory note

- Mortgage or deed of trust

- Closing disclosure

- Deed transferring ownership

- Various affidavits and declarations

- Pay closing costs and down payment

- Transfer of property ownership officially recorded

After Signing

- Funding: Lender releases mortgage funds

- Recording: Documents are filed with local government

- Disbursement: Funds are distributed to seller and other parties

- Keys handover: You officially become a homeowner!

Closing on a House Timeline: FAQ

Q: Can you close on a house in less than 30 days?

A: Yes, especially with conventional loans or cash purchases. However, even with optimal conditions, most financed purchases take at least 3-4 weeks due to mandatory waiting periods and processing requirements.

Q: What’s the fastest way to close on a house?

A: An all-cash purchase offers the fastest closing timeline, potentially within 7-14 days. Without financing contingencies, many time-consuming steps are eliminated.

Q: How can I avoid delays in my closing timeline?

A: Be thoroughly prepared with all financial documentation, maintain stable employment and finances during the process, choose experienced professionals, and respond promptly to all information requests.

Q: Should I schedule my move on the closing date?

A: It’s generally advisable to schedule your move at least 1-2 days after your scheduled closing to account for unexpected delays. This buffer provides peace of mind and reduces stress.

Q: What happens if closing is delayed?

A: If closing is delayed, the purchase agreement may need to be amended with a new closing date. In some cases, financial penalties may apply depending on the terms of your contract and which party caused the delay.

Remember that clear communication, prompt responses, and working with experienced professionals are your best allies in achieving a successful and timely closing.

Whether you’re a first-time homebuyer or seasoned property investor, proper preparation and realistic expectations will help ensure that your closing experience proceeds as smoothly as possible—bringing you that much closer to receiving the keys to your new home.

At Homeowner.org, we’re here to guide you along the way in your journey regarding all things related to buying, owning, and loving your home. Check out our site for more today.