The topic of home improvements and associated taxes may seem daunting for homeowners. Home improvements, in particular, attract the attention of numerous Americans every year as they contemplate projects to enhance their home’s comfort, value, or aesthetic appeal. A key question becomes particularly essential: are these home improvement expenditures tax-deductible? In this article, we’ll unravel this question by exploring the concept of tax deductions, discussing what constitutes a home improvement, and identifying what type of expense could qualify for a home improvement tax deduction under certain circumstances.

Understanding Tax Deductions

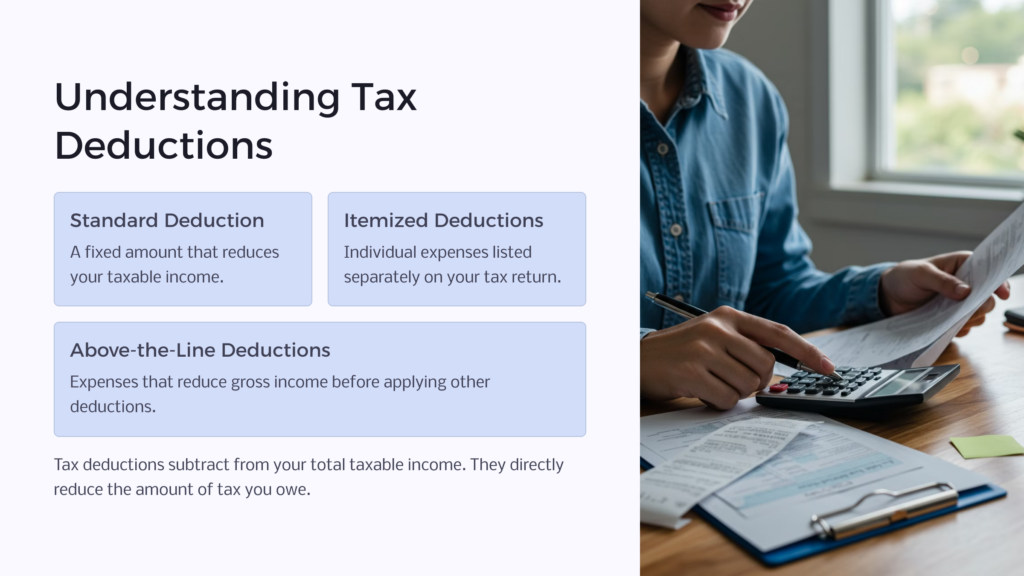

Firstly, it is crucial to understand what a tax deduction involves. Essentially, a tax deduction is a subtraction from your total taxable income, directly reducing the amount of tax you owe. There are different types of tax deductions, such as the standard deduction, itemized deductions, and above-the-line deductions. Depending on individual circumstances, taxpayers may utilize specific deductions to decrease their taxable income, thereby reducing the overall tax bill.

Home Improvement Expenses

Home improvements refer to renovations, upgrades, or installations made to a home that enhance its value, utility, or adaptability. These could include projects such as kitchen upgrades, adding a new room, installing energy-efficient systems, or utilizing accessibility equipment for individuals with disabilities. While it may seem like home repair or improvement expenses should be tax deductible, this isn’t entirely accurate, the specifics of which we shall delve into in the next section.

Are Home Improvements Tax Deductible?

At their core, home improvements are typically not tax-deductible. This stipulation is outlined by the Internal Revenue Service (IRS) in their guidelines concerning a deduction or tax break. However, there are certain circumstances for tax deductible home improvements.

For example, if a homeowner borrows against their home to fund improvements, the interest paid on any home improvement loans might be deductible under the mortgage interest deduction. Additionally, improvements made for medical reasons — such as installing ramps or lifts for disabled residents — might make the home repairs tax deductible as medical expenses. Lastly, when selling a house, improvements made on the home can reduce the amount of tax owed on the gains from the sale.

Home Improvements vs. Home Repair

It is essential to differentiate between a home improvement project and a home repair project, as the tax deductibility differs significantly. While home repairs — such as fixing a leaky faucet or patching a hole in the roof — generally aren’t tax-deductible, there are unique circumstances where repair expenses could qualify for deductions.

For instance, if a part of your home is used exclusively for business, the costs of your home office improvements or repairs within that space might be tax-deductible. Additionally, repairs that are part of an overall renovation project can also qualify.

Home Improvement Tax Deduction Alternatives

Next, there are some alternatives to home improvement deductions you might consider. The more common ones include the Home Office Deduction, Capital Improvements, and Medical Equipment Upgrades.

The Home Office Deduction is a tax break for those who use parts of their home exclusively and regularly for business. Capital improvements involve augmentations that enhance the home’s value and last longer than a year, such as installing a new roof or adding a swimming pool. These expenses could potentially reduce your capital gains taxes when selling your home.

Lastly, medical equipment upgrades pertain to home improvements related to medical care. This can include anything from installing a wheelchair ramp to renovating bathroom facilities to accommodate someone with disabilities. These substantial improvements might be deductible as medical expenses.

How to Claim Home Improvement Deductions

Claiming these deductions requires careful record-keeping and understanding of IRS regulations. It’s advisable to carefully track all your home improvement expenses and keep receipts, loan documents, and before-and-after photos as proof. You will need to itemize your deductions on Schedule A of your tax return, which entails more paperwork and diligence than claiming the standard deduction.

For deductions related to Business use of your home, you will need to use either the Simplified Option or the Regular Method, depending on your specific circumstances. For Capital Home Improvements, your Home Sale Records will be essential. For Medical Home Improvements, deductions can be claimed only if their total costs exceed 7.5% of your adjusted gross income.

We’re Here To Help

So, while most home improvements are not directly tax-deductible, there are unique situations where specific expenses related to home improvements can be considered for deductions. Understanding these distinctions and the related tax implications is vital for smart home ownership and financial planning. Check us out at Homeowner.org for more information on all things home-related, and get pre-approved today to either buy or refinance your home.