Despite its iconic role as a major milestone of adulthood for people living in the US, homeownership is more “American Dream” than obtainable reality for many. Even if you currently own a home or have made real estate purchases in the past, the half-decade leading up to 2025 has strained finances almost across the board.

Whatever your current situation, your credit score can have a hefty impact on your ability to afford (or even buy) a house.

Minimum Credit Score for a Mortgage

Let’s make things easy, and start with the most critical information, here. Across mortgage types, lenders, and other factors, the most common figure used as a baseline in the industry is 620. Especially for conventional loans, you will likely experience difficulty when trying to land a mortgage with a score lower than that.

Now, that being said, you’re not necessarily out of luck if your score is lower than 620, and having one higher than that isn’t a guarantee you’ll be allowed to sign on the dotted line.

Credit Score Requirements for Different Mortgage Types

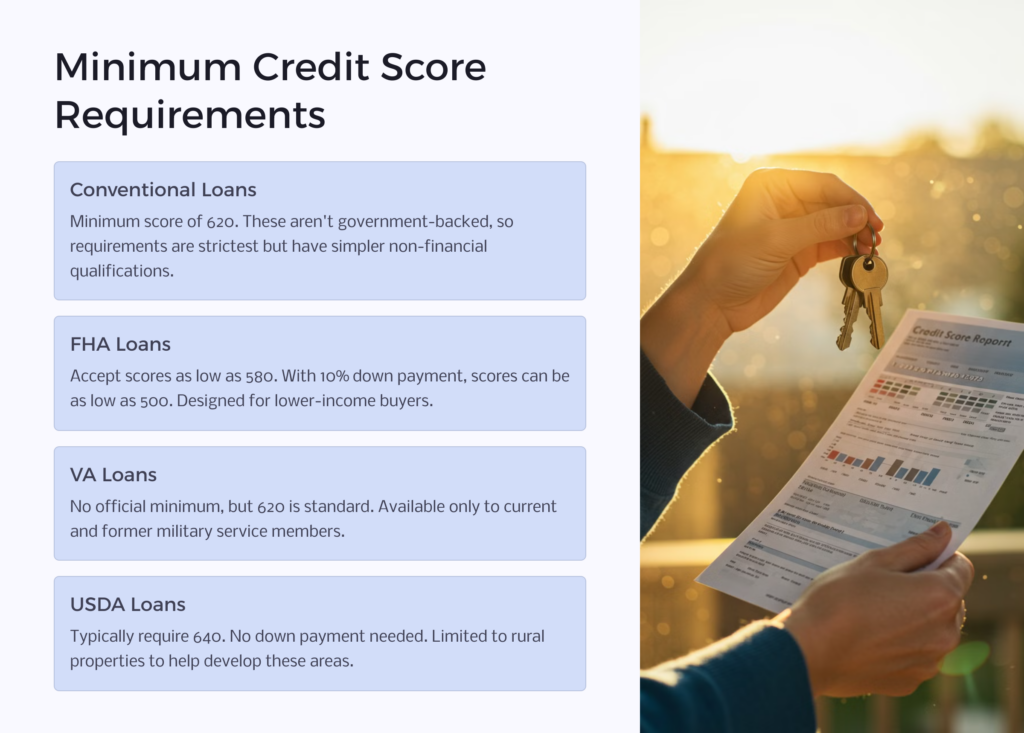

There are primarily four different “flavors” of mortgage available in the US:

- Conventional

- FHA

- VA

- USDA

Conventional Mortgages

These loans constitute the baseline, here (hence “conventional). They aren’t subsidized or guaranteed by the government, so the requirements to qualify are the strictest—from a financial standpoint, at least. On the flip side, the non-financial requirements are the simplest with conventional mortgages. Anyone can apply for and get a conventional loan.

You just have to have the financial stability to prove to lenders that you’re not a flight risk.

To qualify for a first-time, conventional mortgage in 2025, most lenders will require a credit score of at least 620. Few (if any) will budge on that figure. Those who do will undoubtedly have increased expectations elsewhere.

FHA Mortgages

Federal Housing Administration (FHA) loans are designed to help lower income buyers, who may otherwise struggle to afford a home through conventional mortgages. The Federal Housing Administration insures these loans, guaranteeing them against buyers should they default on their loan.

Lenders have to be vetted and approved by the FHA, and buyers have to meet the means testing metrics to qualify as a candidate for an FHA loan. The upside is that the financial bar is much lower, and easier to clear.

FHA loans can accept buyers with credit scores of 580 or higher. Beyond that, buyers that can supply a downpayment of at least 10% can get away with scores as low as 500.

VA Mortgages

VA loans are similar to FHA loans, in that the government serves as guarantor for the buyer. The difference here is that VA loans are backed by the Department of Veteran Affairs (VA).

Qualifying for VA loans is fairly straightforward: there’s no set minimum, but 620 is treated as the de facto standard. No downpayment is required, and loan limits are much more forgiving (making it easier to buy homes in expensive regions).

However, in order to be eligible for a VA loan, you have to meet VA benefit requirements. Broadly speaking, that means VA loans are issued strictly to current and former service members of the armed forces.

USDA Mortgages

Finally, we have USDA loans. These are also backed by a federal organization: the US Department of Agriculture (USDA) to be precise.

The idea here is similar to FHA and VA mortgages—help borrowers to purchase their first home when conventional loans prove too difficult to afford. USDA loans have no strict credit score requirement, but 640 is a common expectation. While that’s higher than conventional loans, USDA loans forgo down payments entirely, so you have lower upfront costs.

Beyond credit scores, USDA loans also limit a borrower’s options based on location and property size. This is because USDA loans are intended for use to help develop rural areas (where populations tend to be lower, and agriculture tends to be a pillar of the local economy).

Are Credit Score Requirements Non-Negotiable?

Well, yes, and also no.

Expectations will vary by loan type, lender, by location, by property, and by borrower (your credit score is just one factor they look at).

We’ll go into more detail below, but quite a few factors play a part in this equation, and in theory, problematic credit scores can be offset by meeting more lofty expectations in other areas (such as down payments). In other words, be upfront with your lender, ask them what your options are, and don’t be afraid to shop around if need be.

Why Does My Credit Score Even Matter?

We think of banks, credit unions, and financial institutions as being in the business of finance. But it’s equally accurate to describe them as being in the business of risk.

Think of that one friend you had growing up who would always ask you to spot them $20. “I’m good for it,” they assure you. Your mileage may have varied on just how true their claim was.

In a similar way, banks want some way to gauge how likely it is that you’ll pay back money that they loan you. Your credit score is one of the methods they use to do just that. Known as a FICO® Score, it’s a numerical figure calculated based on your history of debt, repayment, and financial reliability.

Long story short, the higher your credit score, the more the lender will breathe easy and feel confident that they can trust you to repay the mortgage in full.

What that looks like from the borrower’s perspective is this: higher credit scores result in better approval rates, better lender options, and more favorable interest rates for you.

Well, How High of a Credit Score Should I Have?

How good of a grade do you want on a test? How full do you want your gas tank? How big do you want your TV?

At the risk of oversimplifying, the higher your score, the better. There are no downsides to a high credit score. A FICO® Score can range from 300 to 850, and the closer to 850, the better off you’ll be.

If you’re asking how high it should be to be considered “awesome credit,” anything north of 700 is a safe bet, and from about 740 up is the sweet spot.

So How Do I Get My Score Up?

Earning a good credit score is…kind of weird. It’s not enough to never be late on any payments; if that were the case, every freshly minted high school graduate would have a credit score of 850 by default. To build credit, you have to acquire debt, then manage it in a satisfactory manner, over an extended period of time.

If you’ve never had a credit card, a car loan, or any other form of debt, you probably won’t have a stellar credit score. Bringing it up will require doing things like opening lines of credit (read: credit cards), and then using them in moderation, paying them off each month as you go. As long as you keep the card open, and keep the balance paid off, your credit should build.

For those with more credit history that are still looking to make improvements, you’ll have to combine strategies for increasing your score with strategies that prevent decreases.

Bring your score up by:

- Reducing your overall liability (paying down balances)

- Getting current on any account that’s delinquent

- Halting or limiting further spending on credit

- Paying on time, everytime

- Keeping credit utilization low (i.e. your current balance vs. your max spend limit)

Prevent further hits to your credit by:

- Avoiding applying for new credit, loans, and other debt (each application dings your score a bit)

- Keeping credit accounts open, even if no longer used (as it contributes to your debt history)

- Avoiding co-signing on someone else’s application

If you find you’re struggling to hit some of these, especially if payments are getting away from you, start by calling your lenders and discussing your situation with them. Most have programs available to help you meet your liabilities without overtaxing your finances, and communicating with them directly can minimize the negative impact on your credit.

What Else Impacts My Qualifications?

We’ll wrap up here by talking about, well, everything else that goes into a mortgage application. Lenders look at more than just your credit score, after all, and some of these may outweigh your credit score (for better or worse) in your particular situation.

In addition to credit scores, lenders also look at factors like:

- Debt-to-income ratio

- Down payment amount

- Co-borrowers (such as a spouse)

- Co-signers

- Income for all relevant parties

As illustrated by FHA above, a larger down payment can do a lot to compensate for a lower credit score. You can, of course, pay for a house in full outright if you have that much change in your piggy bank. If that was a realistic option, though, you probably wouldn’t be reading this article.

What Can I Do if I’m Disqualified?

Attempting to purchase a home these days can be complicated, expensive, and frankly, a little discouraging. And taking on more debt than your finances can handle is poor advice in general. But even if a lender tells you you’re disqualified, you still have options at your disposal.

- Get a second opinion. Talk to other lenders, loan experts, and even people in your contact list who have recently bought a property. Odds are, someone you speak to can either help you find a mortgage that aligns with your current situation, or can help you put plans in place to make a purchase in the near future.

- Ask for help. Any lenders you currently have credit with may be willing to work with you to manage your liability and protect your credit score. Friends and family may be able to help you raise funds for a down payment or by co-signing. And depending on your situation or where you live, there may be programs available to you that we can’t fit into the discussion here.

- Make a plan. Housing prices, interest rates, and available properties ebb and flow over time, as do your personal finances. It may be that your smartest move is to plan ahead, and start working toward purchasing a home in the near future, so you can be better prepared to meet mortgage qualifications.

Check us out at Homeowner.org for more on home warranties, home improvement, and home remodeling. We’d love to help you optimize your experience as a homeowner!