Closing on a house is the final step in your home buying journey. It’s when you officially become the owner of your new home. The closing process can seem complicated, but it’s really just a series of steps to make sure everything is in order before you get the keys.

During the closing, you’ll sign a lot of papers. These documents transfer the home’s ownership from the seller to you. You’ll also finalize your mortgage if you’re using one to buy the house. It’s important to understand what you’re signing, so don’t be afraid to ask questions.

The closing usually happens at a title company’s office or a lawyer’s office. You’ll meet with several people, including the seller, real estate agents, and sometimes a lawyer. The whole process can take a few hours, so be prepared to spend some time there.

How Long Does It Take to Close on a House?

The time it takes to close on a house can vary, but it usually takes about 30 to 60 days from when your offer is accepted. This might seem like a long time, but there’s a lot that needs to happen before you can close.

During this time, your lender will be working on your mortgage approval. They’ll check your credit, verify your income, and make sure the house is worth what you’re paying for it. This process is called underwriting, and it’s a big part of why closing takes as long as it does.

The seller will also be doing things during this time. They might need to fix things in the house or clear up any issues with the property’s title. All of these steps take time, but they’re important to make sure everything is ready for you to become the homeowner.

If everyone involved works quickly and there are no problems, closing can sometimes happen faster. But it’s good to plan for it to take at least a month so you’re not surprised if it does.

Essential Steps Before Closing

Before you get to closing day, there are several important steps you need to take. First, you’ll need to get a home inspection. This is when a professional looks at the house to make sure there aren’t any big problems. If they find issues, you might need to negotiate with the seller to fix them.

Next, your lender will order an appraisal. This is to make sure the house is worth what you’re paying for it. If the appraisal comes in low, you might need to renegotiate the price or come up with more money for a down payment.

You’ll also need to get homeowner’s insurance. Your lender will require this to protect their investment in your home. Shop around for the best rates and coverage that fits your needs.

Lastly, you’ll want to do a final walk-through of the house, usually a day or two before closing. This is your chance to make sure the house is in the condition you expect and that any agreed-upon repairs have been made.

The Role of Escrow in Home Buying

Escrow is an important part of the home buying process. It’s like a neutral third party that holds onto money and important documents until everything is ready for the sale to be completed.

When you make an offer on a house, you’ll usually put down “earnest money.” This shows the seller you’re serious about buying. The escrow company holds onto this money to keep it safe. If the sale goes through, it goes towards your down payment. If something goes wrong and you have to back out of the deal for a reason allowed in your contract, you can get this money back.

Escrow also helps make sure that all the conditions of the sale are met before money changes hands. This protects both you and the seller. Once everything is ready, the escrow company will handle transferring the money to the seller and the deed to you.

Title Search and Insurance

A title search is an important step in buying a house. It’s a detailed look at the property’s history to make sure the seller has the right to sell it to you. The search can find problems like unpaid taxes, liens (legal claims on the property), or disputes about who owns the land.

If any issues come up in the title search, they need to be fixed before you can close on the house. This is why it’s important to start the title search early in the process.

Title insurance protects you if any problems with the title come up after you buy the house. There are two types: lender’s title insurance (which protects the bank) and owner’s title insurance (which protects you). Your lender will require their insurance, but owner’s insurance is optional. However, it’s usually a good idea to get it to protect your investment.

Preparing for Your Final Walk-through

The final walk-through is your last chance to check the house before you buy it. It usually happens a day or two before closing. This isn’t the time for a detailed inspection (that should have happened earlier), but it is your chance to make sure everything is as it should be.

During the walk-through, check that:

- All agreed-upon repairs have been made

- Nothing has been damaged since your last visit

- All items included in the sale (like appliances) are still there

- Everything works (turn on lights, run water, flush toilets)

- The seller’s stuff has been moved out

If you find any problems during the walk-through, tell your real estate agent right away. They can help you figure out how to handle the issue before closing.

Negotiating Closing Costs

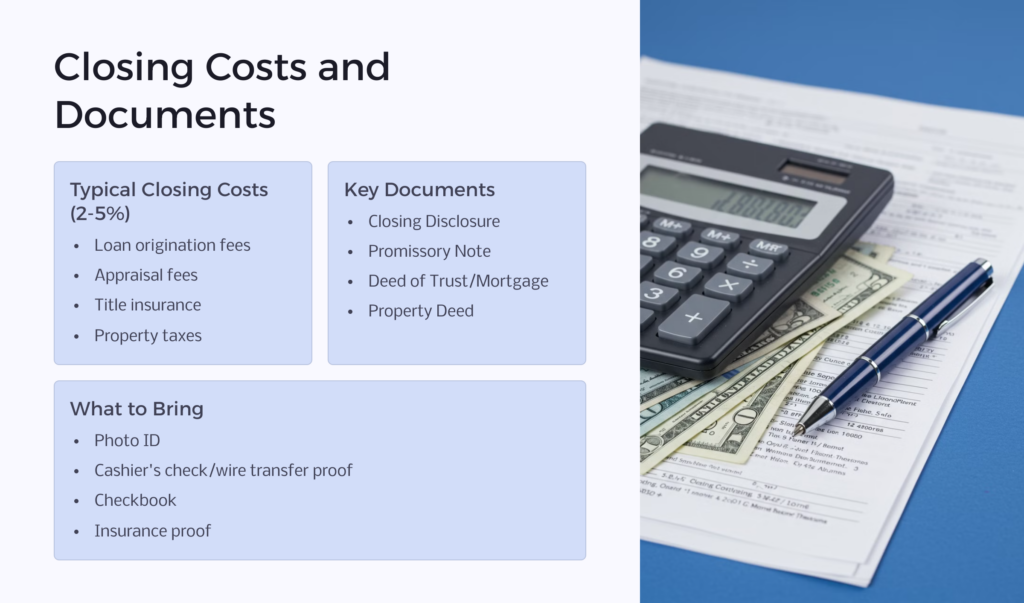

Closing costs are all the fees and expenses you have to pay to finalize your mortgage and complete the purchase of your home. These can add up to 2-5% of the purchase price of the home. Some common closing costs include:

- Loan origination fees

- Appraisal fees

- Title insurance

- Property taxes

- Homeowners insurance

You might be able to negotiate some of these costs. For example, you could ask the seller to pay some of the closing costs as part of your offer. Or you might be able to shop around for some services, like title insurance, to find better rates.

Your lender will give you a Loan Estimate that lists all the closing costs. Review this carefully and ask questions about anything you don’t understand. You have the right to know what you’re paying for.

Understanding Your Closing Documents

At closing, you’ll sign a lot of documents. It’s important to understand what each one means. Here are some of the key documents you’ll see:

1. Closing Disclosure: This shows all the final details of your loan, including the interest rate, monthly payments, and closing costs. You should get this at least three days before closing.

2. Promissory Note: This is your promise to repay the loan. It includes the terms of your mortgage.

3. Deed of Trust or Mortgage: This document gives your lender a claim against your house if you don’t pay the loan.

4. Deed: This transfers ownership of the house from the seller to you.

Don’t be afraid to ask questions about any document you don’t understand. It’s your right to know what you’re signing.

What to Bring on Closing Day

On closing day, you need to bring several important items:

- A government-issued photo ID

- A cashier’s check or proof of wire transfer for your closing costs and down payment

- Your checkbook for any last-minute expenses

- Proof of homeowners insurance

- A copy of your Closing Disclosure

- Any paperwork you’ve received during the home-buying process

It’s a good idea to bring all the paperwork you’ve collected during the home-buying process, even if you’re not sure you’ll need it. It’s better to have it and not need it than to need it and not have it.

Common Roadblocks and How to Avoid Them

Sometimes things can go wrong during the closing process. Here are some common problems and how to avoid them:

1. Loan problems: Make sure you don’t make any big changes to your finances (like taking out a new loan or changing jobs) between applying for your mortgage and closing. This could cause problems with your loan approval.

2. Title issues: Start the title search early so there’s time to fix any problems that come up.

3. Low appraisal: If the appraisal comes in low, be prepared to negotiate with the seller or come up with extra cash.

4. Last-minute walk-through issues: Do your final walk-through early enough that you have time to address any problems before closing.

The best way to avoid roadblocks is to stay in close contact with your real estate agent and lender throughout the process. They can help you navigate any issues that come up.

The Importance of Homeowner’s Insurance

Homeowner’s insurance is crucial when buying a house. It protects your investment if something goes wrong, like a fire or natural disaster. Most lenders require you to have insurance before they’ll approve your loan.

When choosing insurance, make sure you understand what’s covered and what’s not. Basic policies usually cover damage to your house and personal property, and liability if someone gets hurt on your property. But you might need extra coverage for things like floods or earthquakes.

Don’t just go with the cheapest option. Look for a policy that gives you the protection you need at a price you can afford. And remember, you’ll usually need to pay for the first year of insurance at closing.

What Happens After You Close

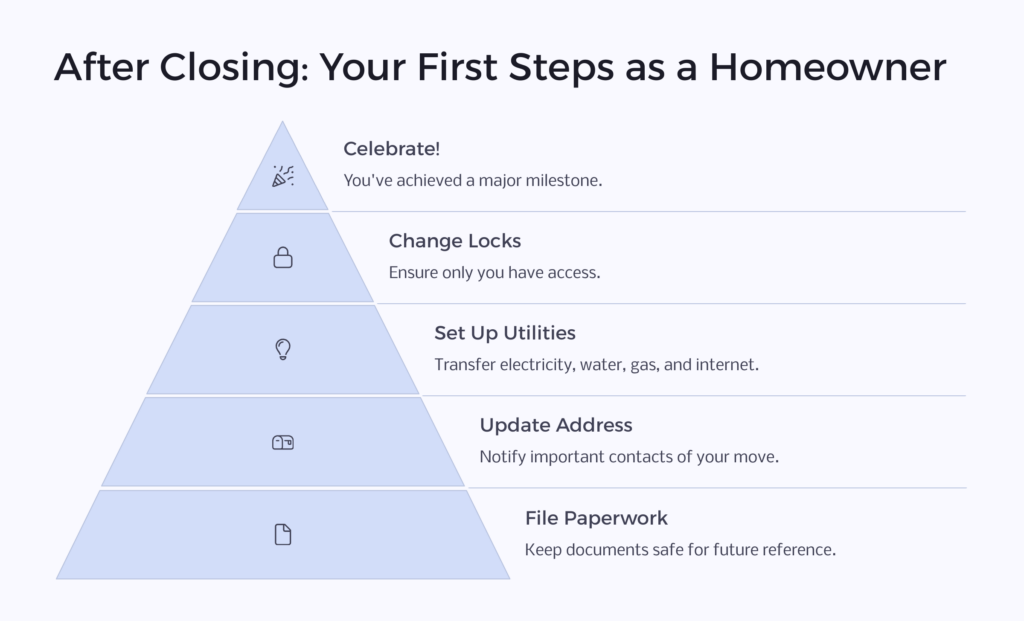

After you sign all the paperwork and hand over the money, you’ll get the keys to your new home. Congratulations! But there are still a few things you need to do:

1. Change the locks: You don’t know who might have copies of the old keys.

2. Set up utilities: Make sure electricity, water, gas, and internet are switched to your name.

3. Update your address: Let the post office, your bank, and other important contacts know your new address.

4. File your paperwork: Keep all your closing documents in a safe place. You might need them for taxes or if you refinance in the future.

5. Plan your move: If you haven’t already, start planning how and when you’ll move your stuff into your new home.

Remember, buying a house is a big deal. Take some time to celebrate this achievement! You’ve worked hard to get here, and now you have a place to call your own.